𝐑𝐄𝐕𝐄𝐍𝐔𝐄 𝐆𝐄𝐍𝐄𝐑𝐀𝐓𝐈𝐎𝐍 𝐈𝐍 𝐀𝐂𝐓𝐈𝐎𝐍

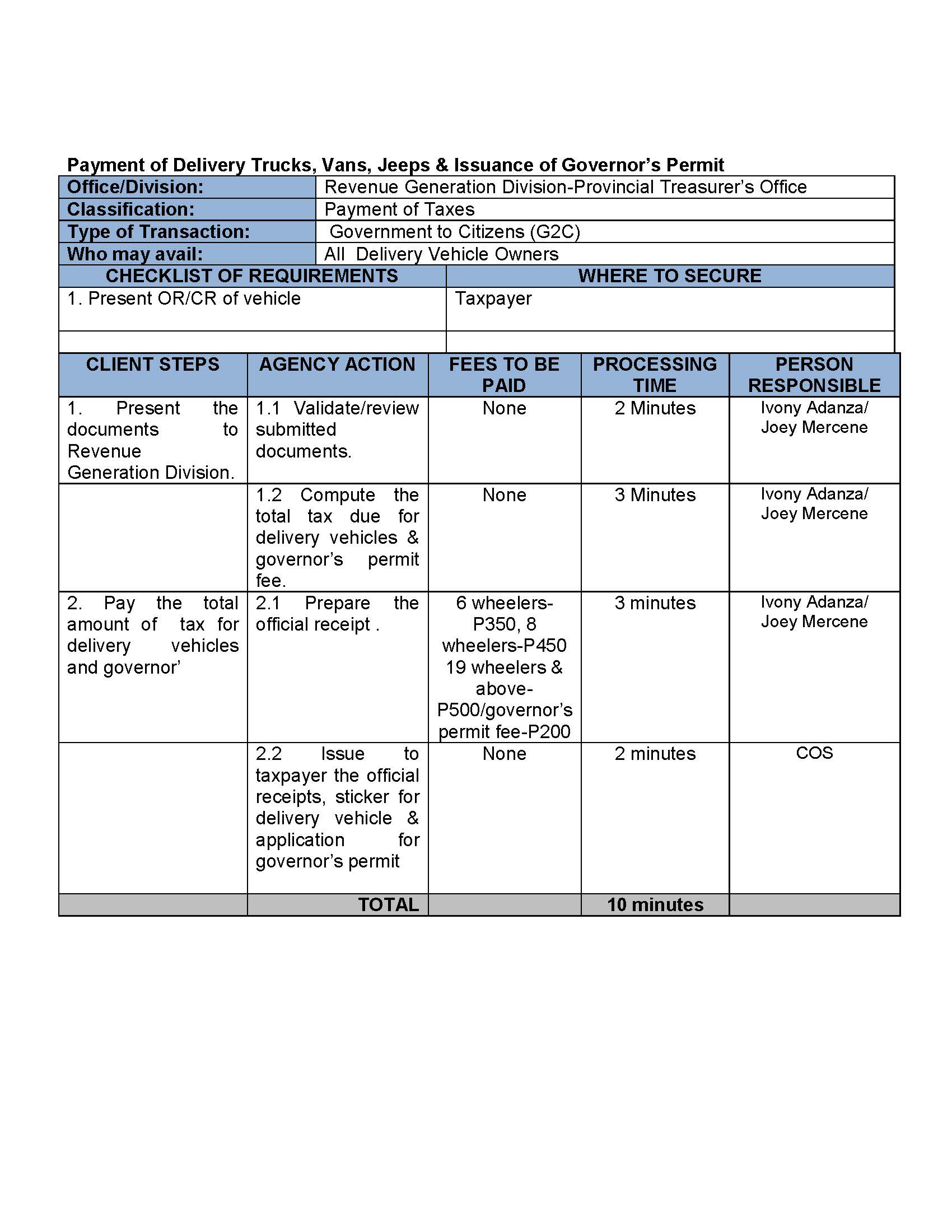

Sa atas ng ating Governor Eduardo B. Gadiano, ang ating opisina ay patuloy sa pangongolekta ng mga Provincial Imposition katulad ng 𝐓𝐚𝐱 𝐨𝐧 𝐝𝐞𝐥𝐢𝐯𝐞𝐫𝐲 𝐭𝐫𝐮𝐜𝐤𝐬 𝐚𝐧𝐝 𝐯𝐚𝐧𝐬 na nakapaloob sa 𝑃𝑟𝑜𝑣𝑖𝑛𝑐𝑖𝑎𝑙 𝑂𝑟𝑑𝑖𝑛𝑎𝑛𝑐𝑒 𝑁𝑜. 2013-005 𝑅𝑒𝑠. 𝑁𝑜. 28 𝑆𝑒𝑟𝑖𝑒𝑠 2014.

𝟏𝐒𝐓 𝐀𝐍𝐃 𝟐𝐍𝐃 𝐐𝐔𝐀𝐑𝐓𝐄𝐑 𝐀𝐔𝐆𝐌𝐄𝐍𝐓𝐀𝐓𝐈𝐎𝐍 𝐀𝐋𝐋𝐎𝐖𝐀𝐍𝐂𝐄

𝐏𝐀𝐌𝐀𝐌𝐀𝐇𝐀𝐆𝐈 𝐍𝐆 𝟏𝐒𝐓 𝐀𝐍𝐃 𝟐𝐍𝐃 𝐐𝐔𝐀𝐑𝐓𝐄𝐑 𝐀𝐔𝐆𝐌𝐄𝐍𝐓𝐀𝐓𝐈𝐎𝐍 𝐀𝐋𝐋𝐎𝐖𝐀𝐍𝐂𝐄 𝐈𝐒𝐈𝐍𝐀𝐆𝐀𝐖𝐀 sa ating mga Barangay Health Workers (BHW) at Barangay Nutritionist Scholars (BNS) noong ika-27 hanggang ika-31 ng Hulyo,2023 sa buong lalawigan ng Occidental Mindoro. Hindi naging hadlang ang ano mang sakuna upang makapagbigay ng ganadong serbisyo sa ating mga mamamayan.

𝐓𝐫𝐚𝐢𝐧𝐢𝐧𝐠-𝐖𝐨𝐫𝐤𝐬𝐡𝐨𝐩 𝐨𝐧 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐀𝐝𝐦𝐢𝐧𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧, 𝐅𝐮𝐧𝐝 𝐌𝐚𝐧𝐚𝐠𝐞𝐦𝐞𝐧𝐭 𝐚𝐧𝐝 𝐀𝐜𝐜𝐨𝐮𝐧𝐭𝐚𝐛𝐢𝐥𝐢𝐭𝐲 𝐨𝐟 𝐋𝐨𝐜𝐚𝐥 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐞𝐫𝐬, 𝐑𝐞𝐯𝐞𝐧𝐮𝐞 𝐂𝐨𝐥𝐥𝐞𝐜𝐭𝐨𝐫𝐬 𝐚𝐧𝐝 𝐨𝐭𝐡𝐞𝐫 𝐓𝐫𝐞𝐚𝐬𝐮𝐫𝐲 𝐏𝐞𝐫𝐬𝐨𝐧𝐧𝐞𝐥 𝐨𝐟 𝐭𝐡𝐞 𝐏𝐫𝐨𝐯𝐢𝐧𝐜𝐞 𝐨𝐟 𝐎𝐜𝐜𝐢𝐝𝐞𝐧𝐭𝐚𝐥 𝐌𝐢𝐧𝐝𝐨𝐫𝐨 𝐚𝐧𝐝 𝐢𝐭𝐬 𝐌𝐮𝐧𝐢𝐜𝐢𝐩𝐚𝐥𝐢𝐭𝐢𝐞𝐬 in coordination with BLGF MIMAROPA Region held last September 26-29,2023 at Thalia’s Events Place, Mamburao Occidental Mindoro

...

PABATID!!!

ALINSUNOD sa "REPUBLIC ACT NO. 12001 ANG REAL PROPERTY VALUATION AND ASSESSMENT REFORM ACT (RPVARA)"

Ang pamahalaang Panlalawigan ng Occidental Mindoro ay nagpapatupad ng AMNESTIYA sa Pagbabayad ng REAL PROPERTY TAX.

Benepisyo ng Amnestiya

Pagbabayad ng buwis mula sa nakaraang taon nang walang karagdagang interes at multa.

Hanggang Kailan

Ang programa ay epektibo hanggang Hulyo 5, 2026 lamang.

PAALALA

Huwag palampasin ang pagkakataong ito upang ayusin ang inyong delingkwenteng buwis.

MAKIPAG-UGNAYAN

Para sa paglilinaw at karagdagang impormasyon, magsadya at makipag-ugnayan sa inyong Pambayan o Panlalawigang Ingat-Yaman..

PAALALA sa lahat ng TAXPAYERS!

Makakakuha po ng 20% diskwento para sa pagbabayad ng inyong Real Property Tax (RPT) para sa taong 2026 kung kayo ay magbabayad ng maaga hanggang Disyembre 31, 2025.

Ito ay para lamang sa mga updated o hinde delingkwente na tax payers at sakop ang lahat ng natitinag at di-natitinag na ari-arian.

Para sa karagdagang impormasyon, makipagugnayan po sa alinmang tanggapan ng Ingat-Yaman sa inyong lugar.

Buwis mo para sa serbisyong ganado!

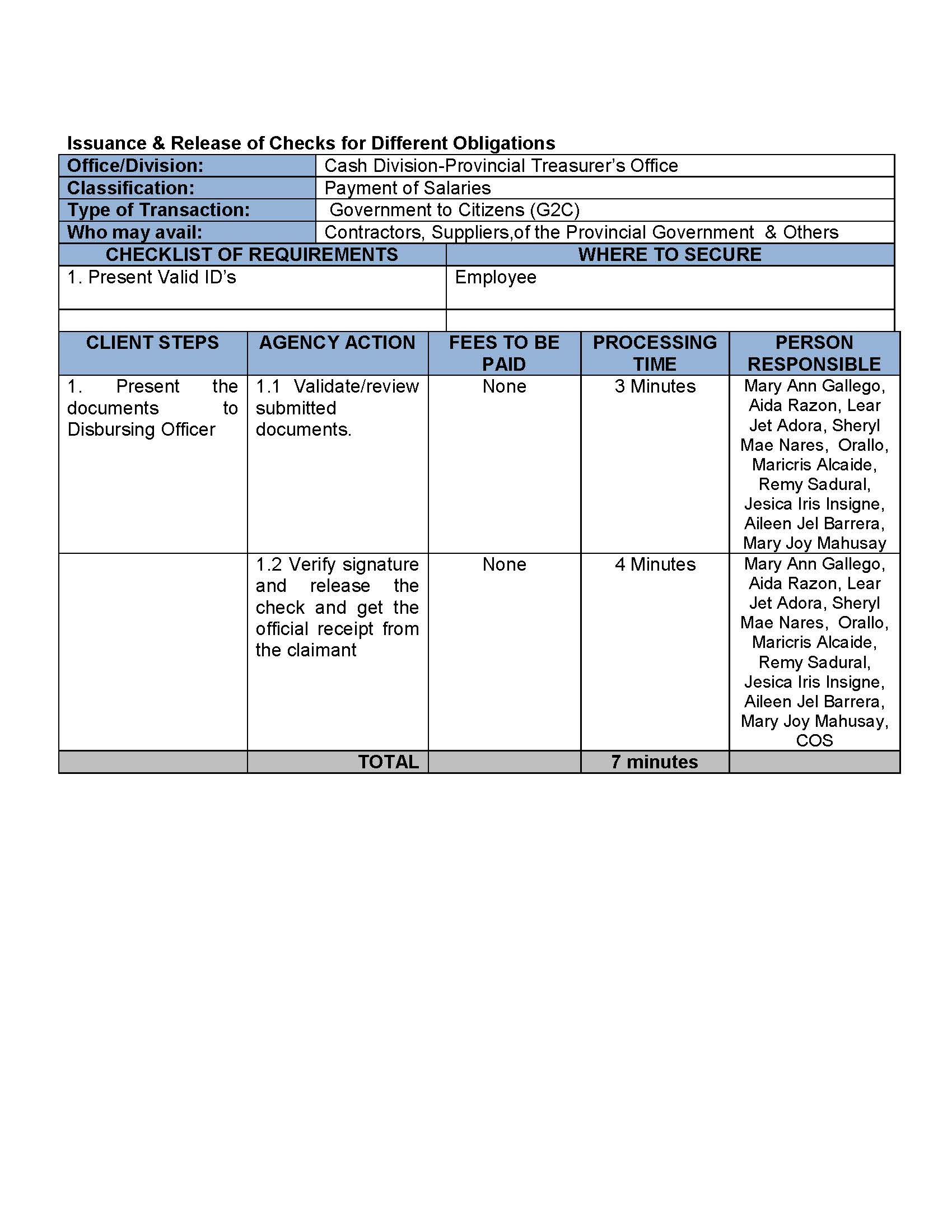

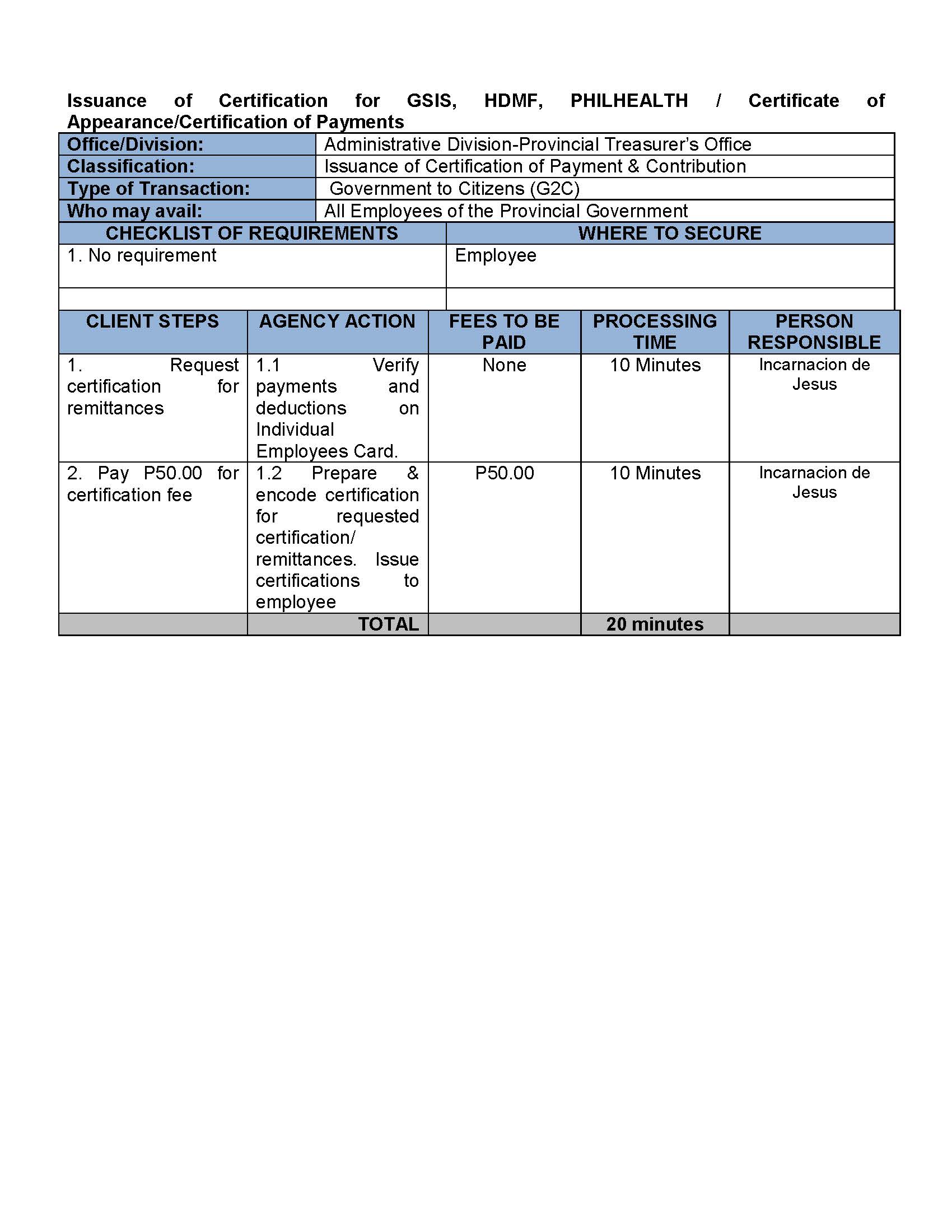

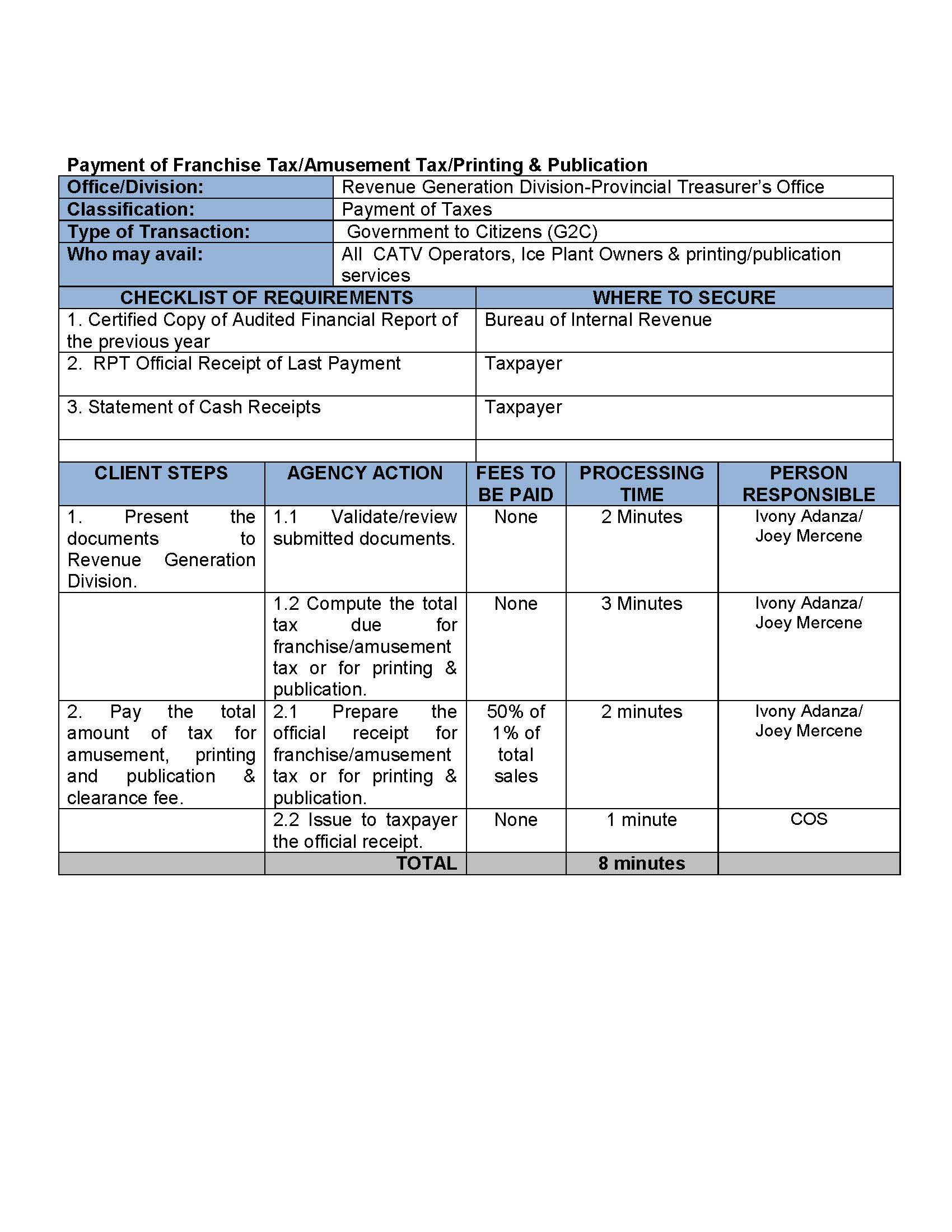

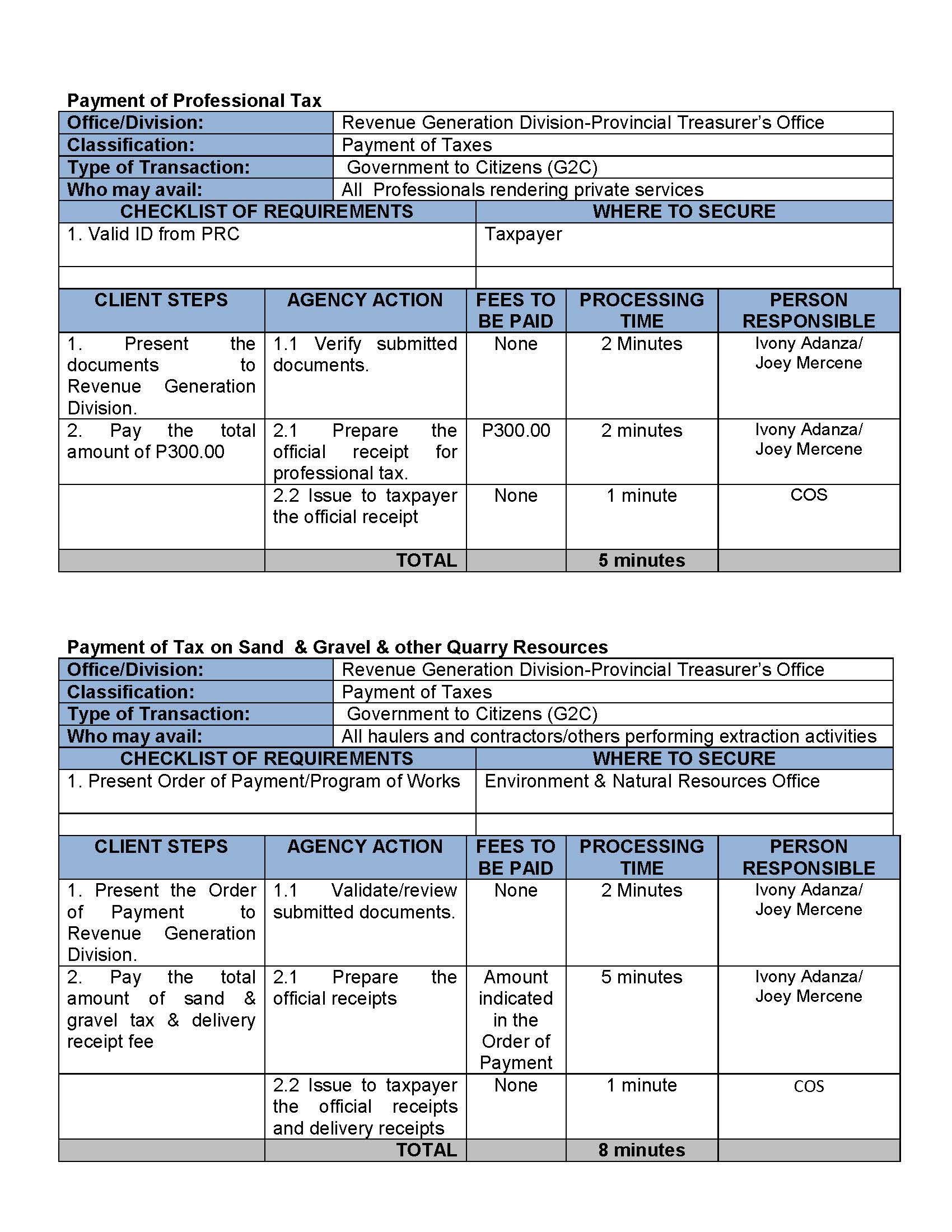

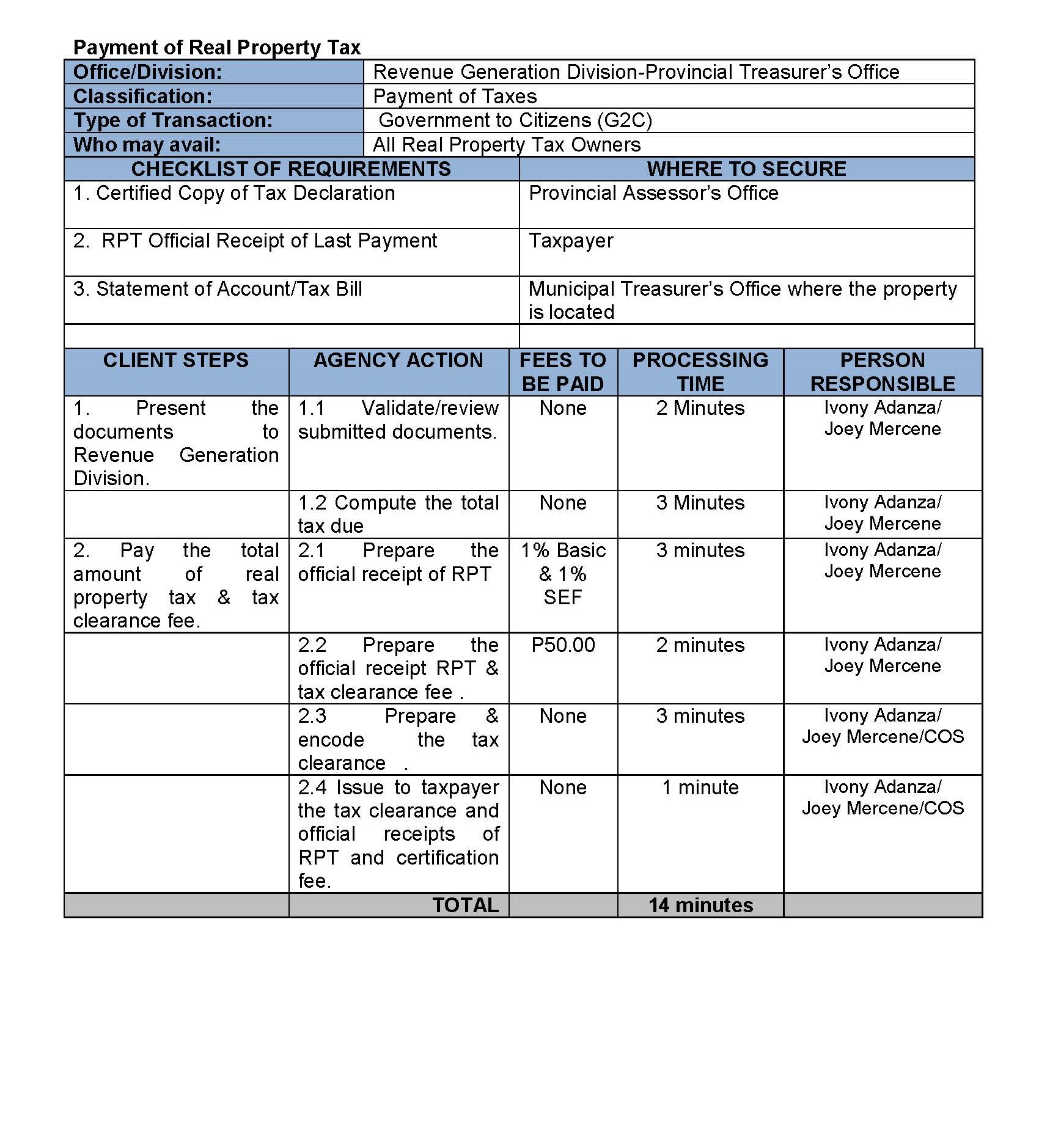

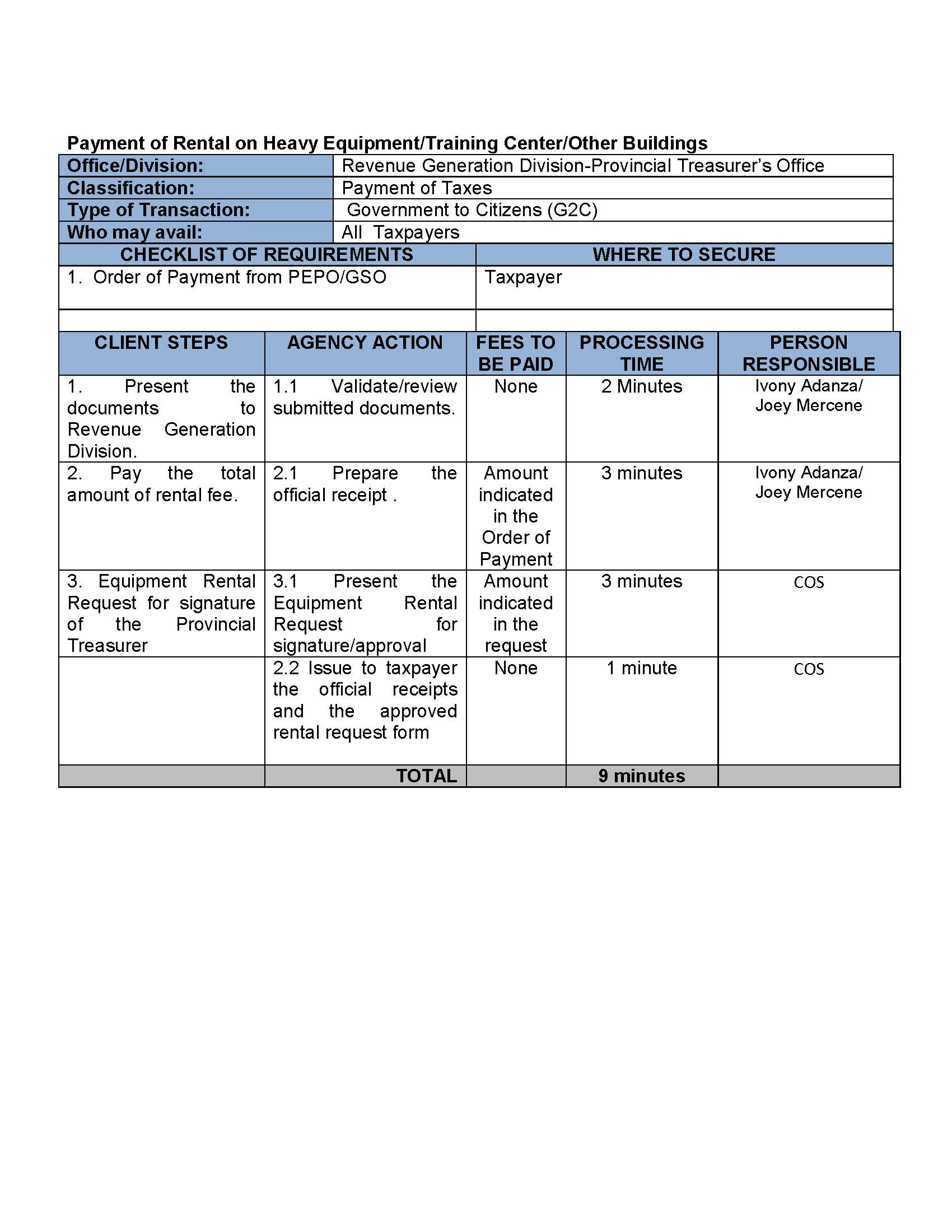

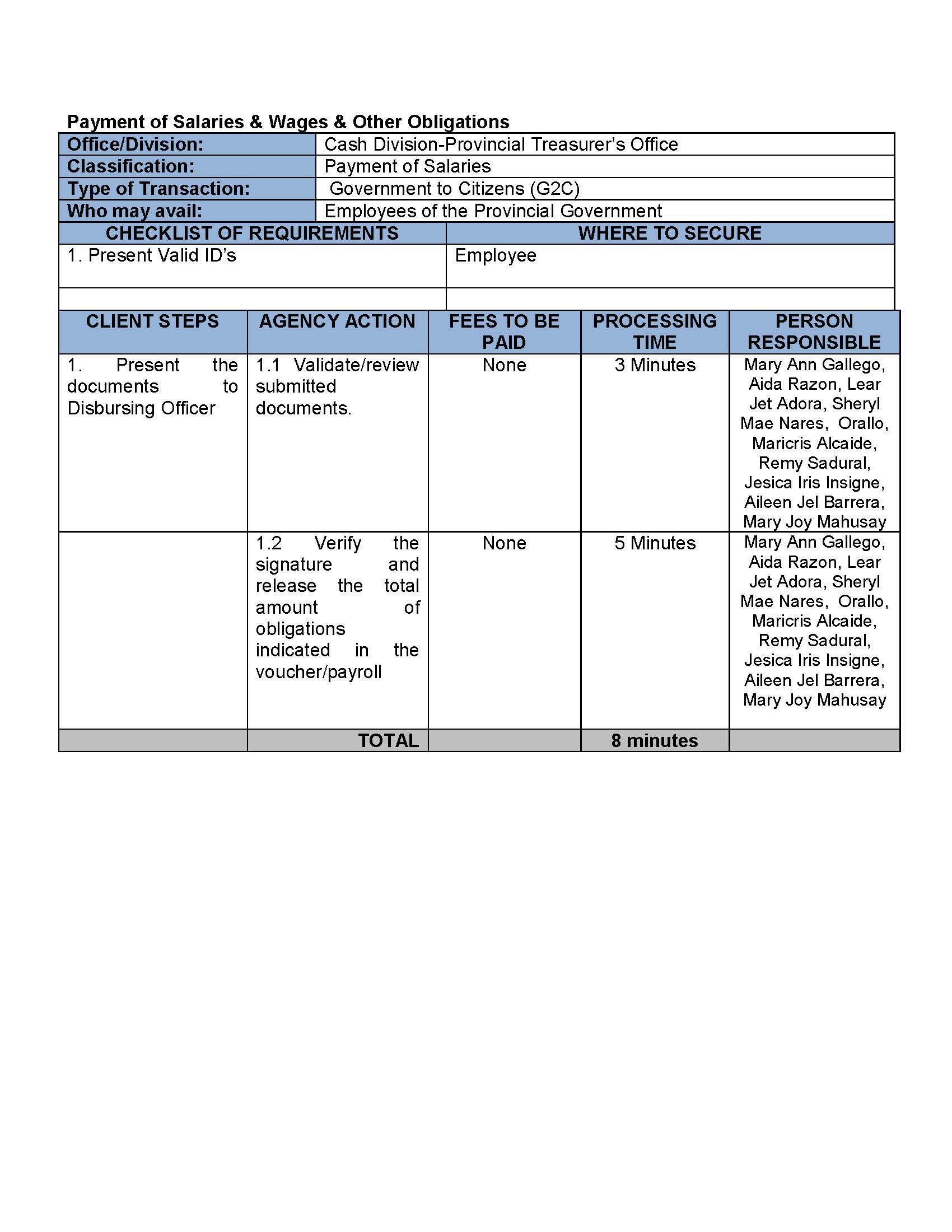

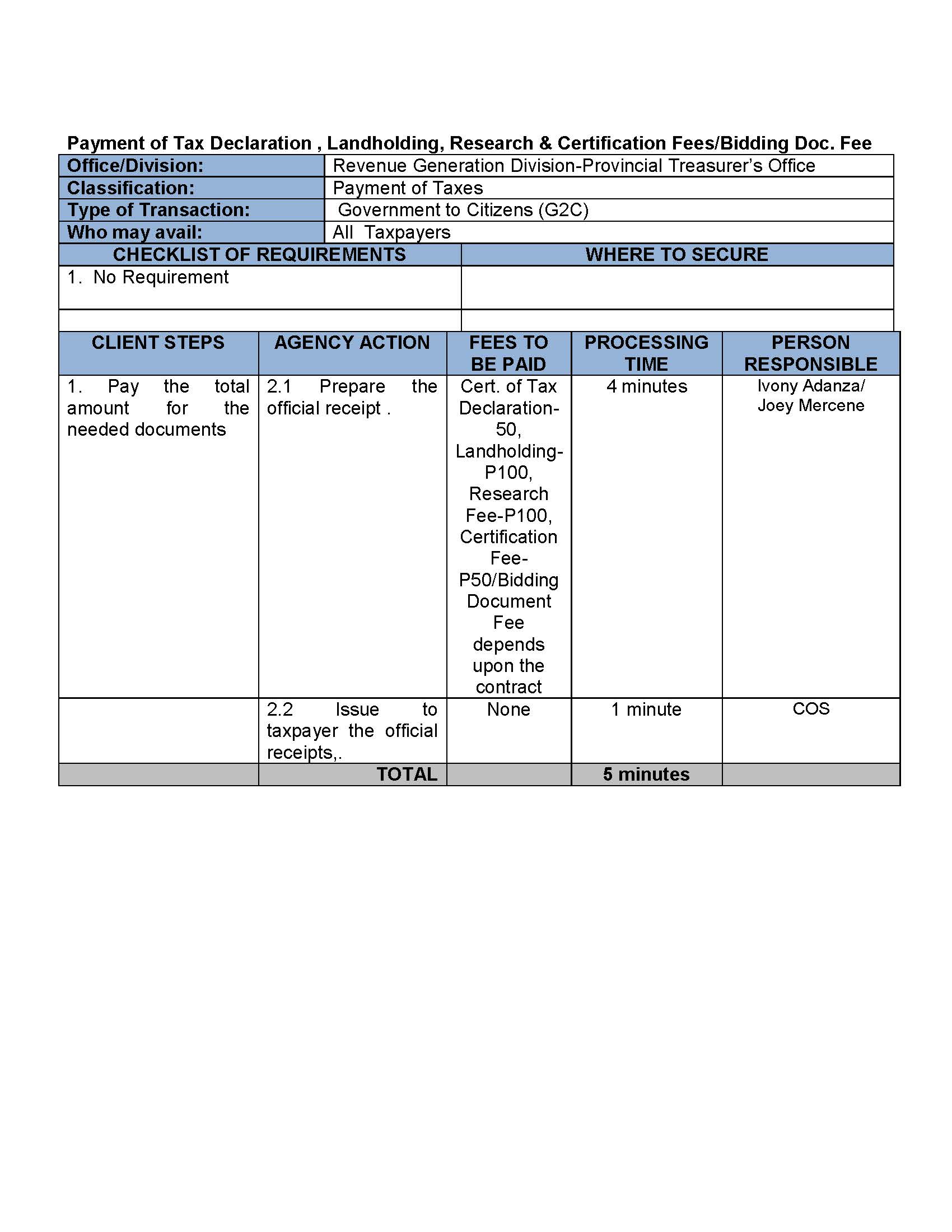

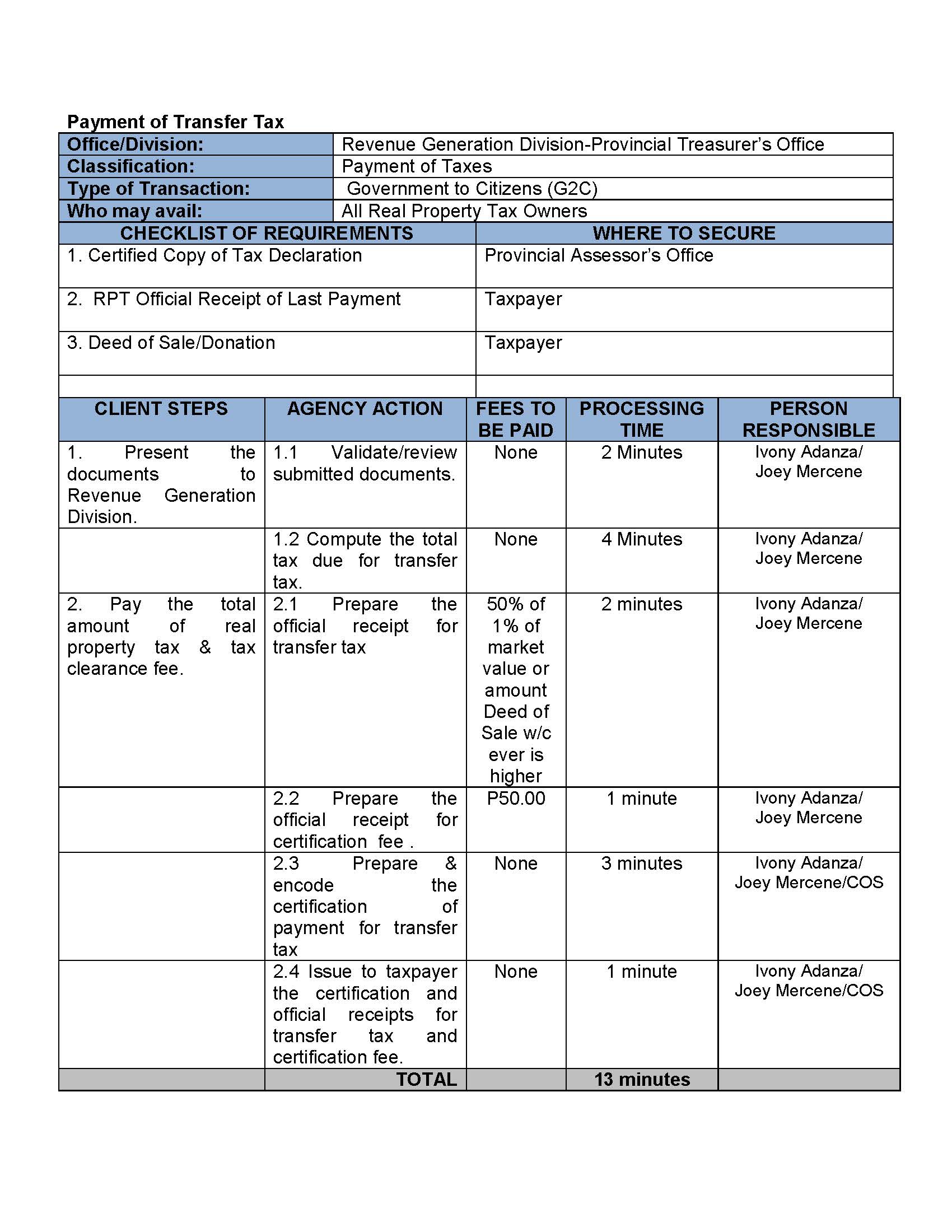

Our Services

Frequently Asked Questions

- Last paid receipt for property dues

- Tax Declaration

- It should be noted that each year of non-payment of property dues may result in an increase in the payable interest.

- Property dues can be paid at the municipal office where your property is located.

- You can also go to the Provincial Treasurer's Office to make the payment. Make sure to bring your latest property dues receipt.

Tax Discounts for Advance & Prompt Payments:

If the real property tax is paid in advance in accordance with the schedule of payment, a discount not exceeding ten percent (10%) of the annual tax due is hereby granted.

- You can avail the discount on tax payments if you have paid your latest property dues; you can receive a 10% discount for the current year.

- A 20% discount is applicable if you pay for the current year and make an advance payment for the next year.

-A penalty will be imposed if you fail to pay property dues. There is a penalty of 2% for every month but not exceeding to 72% if you did not pay according to the scheduled payment.